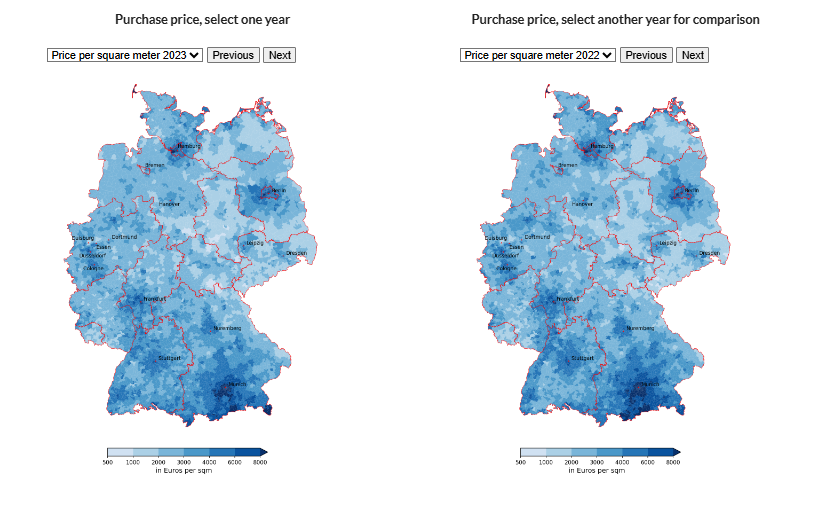

The Berlin School of Economics is pleased to introduce the updated version of an interactive tool developed by researchers Gabriel Ahlfeldt, Stephan Heblich, and Tobias Seidel, which maps property price indices for Germany at a highly detailed, local level. With data available down to the postcode, this tool allows policymakers, analysts, and the public to better understand property and rental price trends across Germany and explore potential applications in local market policies. The latest update includes indices for both rental and purchase prices up to 2023 and is now available online. As a purely academic project with no private-sector involvement, the tool is free to use with proper reference to the original research.

The property price indices tool, based on rigorous academic research, provides a closer look at real estate price variations throughout Germany. By enabling easy year-over-year comparisons, the tool is especially useful for tracking local market dynamics. Professor Ahlfeldt notes, “"Our index is unique in its spatial detail, providing new insights into real estate market conditions at the neighborhood level. With its robust and transparent methodology, it offers a reliable foundation for deriving accurate rental indices and guiding efficient, equitable rent regulations.".”

Professor Gabriel Ahlfeldt joined the Berlin School of Economics as a new faculty member and holds the Chair of Econometrics at Humboldt University in Berlin. Professor Ahlfeldt, also affiliated with the London School of Economics, LSE-CEP, CESifo, and CEPR, brings his expertise in quantitative spatial economics and urban economics, with research spanning finance, labor, political economy, and real estate. His work, including this tool, supports the Berlin School of Economics’ commitment to providing high-impact, policy-relevant research for a broad range of economic applications.

Data on both rental and purchase markets is available for download through the GitHub AHS2023 toolkit, allowing researchers, analysts, and policymakers to use these indices for various projects, from academic studies to practical policy planning. Proper attribution to the original research paper – Ahlfeldt, Heblich, and Seidel (2023): Micro-geographic Property Price Indices – is required for use.