One thing is for certain: the ongoing Covid-19 pandemic in Europe is severe and spreads economic uncertainty. Policy makers and economists alike have understood the threat to the economic system and work jointly on appropriate strategies and policy measures to counteract the downturn. A prerequisite for a successful and elaborate economic policy reaction is and remains a solid data basis. Our analysis helps to understand what is currently going on in the economy by focusing on financial market participants’ expectations of the pandemic’s economic consequences. As the effectiveness of economic policies hinges crucially on expectations, our exercise is a necessary first step in the evaluation of policy measures.

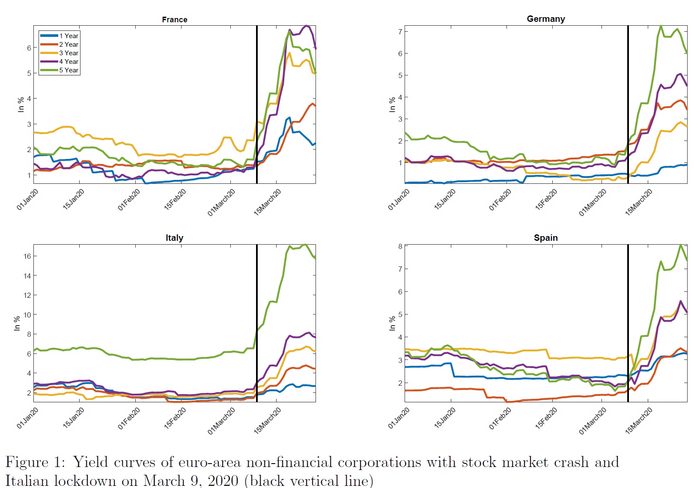

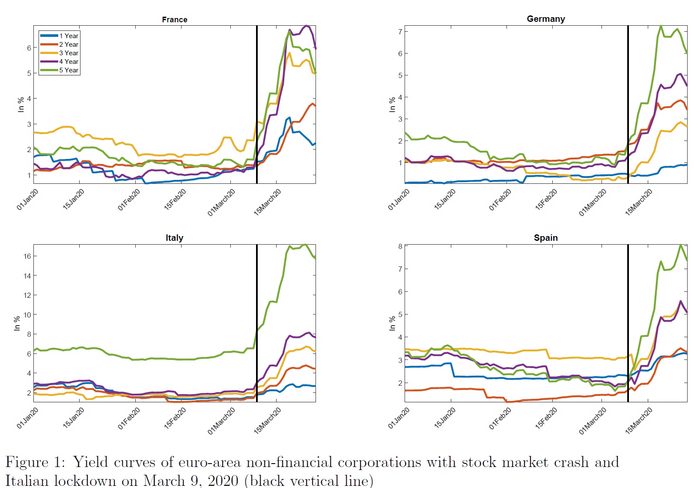

To identify financial market participants’ expectations, we estimate yield curves for a large sample of non-financial corporate bonds of different maturities for France, Germany, Italy, and Spain between 01 January and 27 March 2020. We apply a non-parametric estimation as proposed by McCulloch (1971, 1975), which was recently applied by Bayer et al. (2019). The method models the instantaneous forward rate curve with piecewise cubic polynomials joined at predetermined knot points. The advantage of this approach is its flexibility and its potential to measure accurately expectations at any maturity.

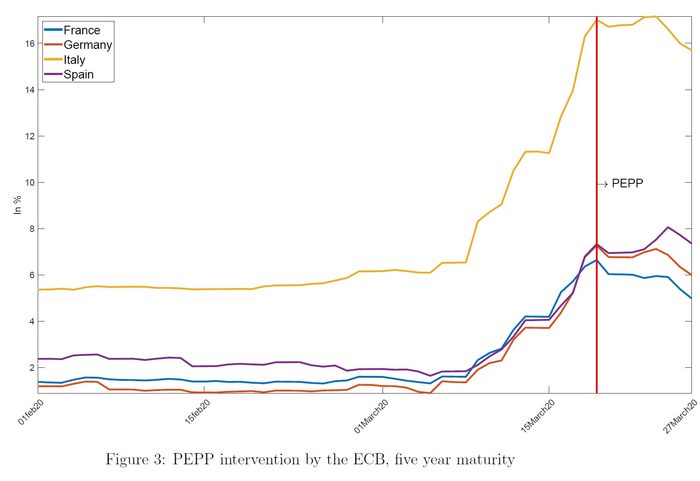

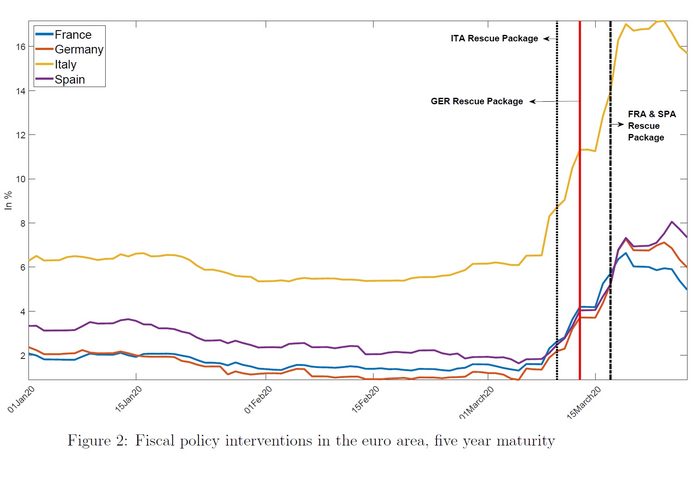

Our exercise allows us to create a differentiated perspective on the topic. First, we can illustrate how financial market participants’ expectations towards the pandemic differ in the short and in the long run. Second, we can carry out an event study and relate the evolution of the yield curves during the pandemic to the most important monetary and fiscal policy measures taken on the European and national level.

Our main findings can be summarized as following:

[insert image 1]

Copyright Ettmeier-Kim-Kriwoluzky

Figure 1:

[insert image 2]

Copyright Ettmeier-Kim-Kriwoluzky

Figure 2:

[insert image 3]

Copyright Ettmeier-Kim-Kriwoluzky

Figure 3:

Conclusion:

Since March 2020 financial market participants expect the economic consequences of the Covid-19 pandemic to be severe and long-lasting. While the ECB’s policy measures helped to stabilize financial market participants’ expectations over all countries, the fiscal policy measures taken so far on a national level still seem to be too irrelevant. Only the announcement of the €550 bn rescue package in Germany coincides with a stabilization of market expectations. A full causal evaluation of the economic policy measures taken as a response to Covid-19 so far still has to be undertaken. But we learn from this event study that an adequate fiscal policy response must be well-coordinated with all European countries being on board.

Full article can be found here.

Bayer, C., Kim, C., & Kriwoluzky, A. 2019: The term structure of redenomination risk.

McCulloch, J. H. 1971. Measuring the term structure of interest rates, The Journal of Business, 44 (1): 19-31.

McCulloch, J. H. 1975. The tax-adjusted yield curve. The Journal of Finance, 30 (3): 811-830.