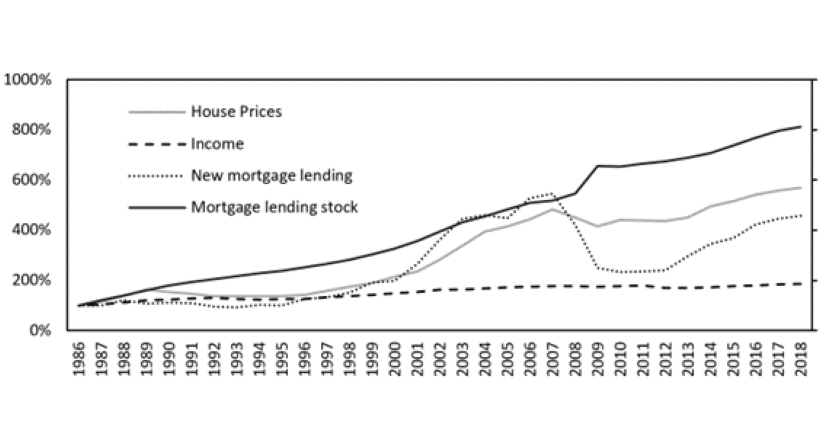

In the past three decades, house prices and mortgage debt in the UK have risen much faster than income (see figure). Two important channels have been established in the literature to explain the positive relationship between house prices and mortgage borrowing. First, if house prices increase, owners want to borrow more to convert the increase in wealth into an increase in consumption. This is the wealth channel which applies mainly to homeowners, but not first time buyers. Second, if house prices increase, households can borrow more since the value of their collateral has increased, making borrowing cheaper and easier to obtain. This is the credit-constraint channel which applies to both homeowners and first time buyers. In a recent CEP discussion paper, we show that if house prices increase, deposit-constrained buyers need to borrow more if they cannot easily downsize to smaller homes. We label this effect of house prices on mortgage demand the housing-consumption channel which applies to all buyers. While intuitive to many (would-be) home buyers, this channel is not consistent with standard economic models in which, when house prices go up, home buyers choose proportionately smaller houses to keep housing expenditure constant.

Naturally, changes in mortgage borrowing observed in data are shaped by all of the abovementioned channels. To disentangle these different channels, we estimate the system of mortgage demand and supply equations using a unique dataset. We combine transaction prices from the UK Land Registry with data on the mortgage value, interest rates, and borrower age and income at the time of the transaction, covering all UK mortgage issuances from 2005 to 2017. Our estimates show that the elasticity of mortgage demand in response to house prices is positive and relatively high, at 0.82. This means that for every 1% increase in house prices, mortgage demand rises by 0.82%. This suggests that housing and non-housing consumption are less easily substitutable than standard economic models assume, where households are expected to downsize to more affordable homes without significantly increasing borrowing.

We incorporate our estimates of the elasticity of mortgage demand with respect to house prices into a broader economic model where the housing and mortgage markets interact. Intuitively, when house prices rise—perhaps due to increasing demand not met by sufficient new supply—households seek larger mortgages. Similarly, when borrowing increases, for instance due to lower interest rates or more competition between banks, housing demand grows as households can afford higher prices. This creates a feedback loop, where rising house prices are amplified through the mortgage market.

We calibrate this model to fit trends in average house prices and mortgage loan sizes in the UK since 1995. Then, we simulate how house prices and loan sizes would have evolved if the elasticity of mortgage demand with respect to house prices was zero. In this hypothetical scenario in which there is no housing-consumption channel, households respond to rising prices by downsizing instead of borrowing more, as assumed in standard models. Our results suggest that without the housing-consumption channel, mortgage borrowing in the UK would be 50% lower than observed. House prices themselves would be 31% lower due to the absence of the feedback loop in this hypothetical scenario. Therefore, the housing-consumption channel is not only intuitive but also quantitatively important.

The size of the housing-consumption channel described in the paper has significant implications for economic vulnerability and housing market cycles. Our results provide a case for macroprudential regulation of mortgage debt. During periods of strong house-price growth, a household will seek higher amounts of mortgage which, without macroprudential interventions such as limits on high loan-to-income or loan-to-value mortgages, will increase the amount of mortgage debt in the economy directly in response to house price increases.

The housing-consumption channel offers a critical insight into the dynamics of the housing market and its broader economic implications. As house prices continue to rise, understanding this channel is essential for policymakers, real estate professionals, and financial planners. The challenge lies in balancing homeownership aspirations with financial stability to avoid a cycle of unsustainable debt. Our study adds to our understanding of the feedback loop between house prices and household leverage and emphasises the role of the housing-consumption channel in driving the loop in conjunctions with the wealth and credit-constraint channel.

Any views expressed are solely those of the authors and should not be taken to represent (or reported as representing) the opinions of the Bank of England or any of its policy committees.

The authors

Gabriel M. Ahlfeldt is Professor of Econometrics at Humboldt University in Berlin, a visiting professor at the London School of Economics, faculty of the Berlin School of Economics, and an affiliate of the Center for Economic Performance, CESifo, and CEPR.

Nikodem Szumilo is an associate professor at University College London and the director at the Bartlett Real Estate Institute. He is also an academic visitor to the Bank of England and a Research Affiliate of the UCL Centre for Finance.

Jagdish Tripathy is a Research Adviser at the Bank of England, with a PhD in Economics and Finance from Universitat Pompeu Fabra, Barcelona.

Reference

This study is published as a working paper under the Berlin School of Economics Discussion Papers series:

Ahlfeldt, G. M., Szumilo, N., & Tripathy, J. (2024). Housing-consumption channel of mortgage demand (Berlin School of Economics Discussion Papers No. 44). Berlin School of Economics. https://doi.org/10.48462/opus4-5572